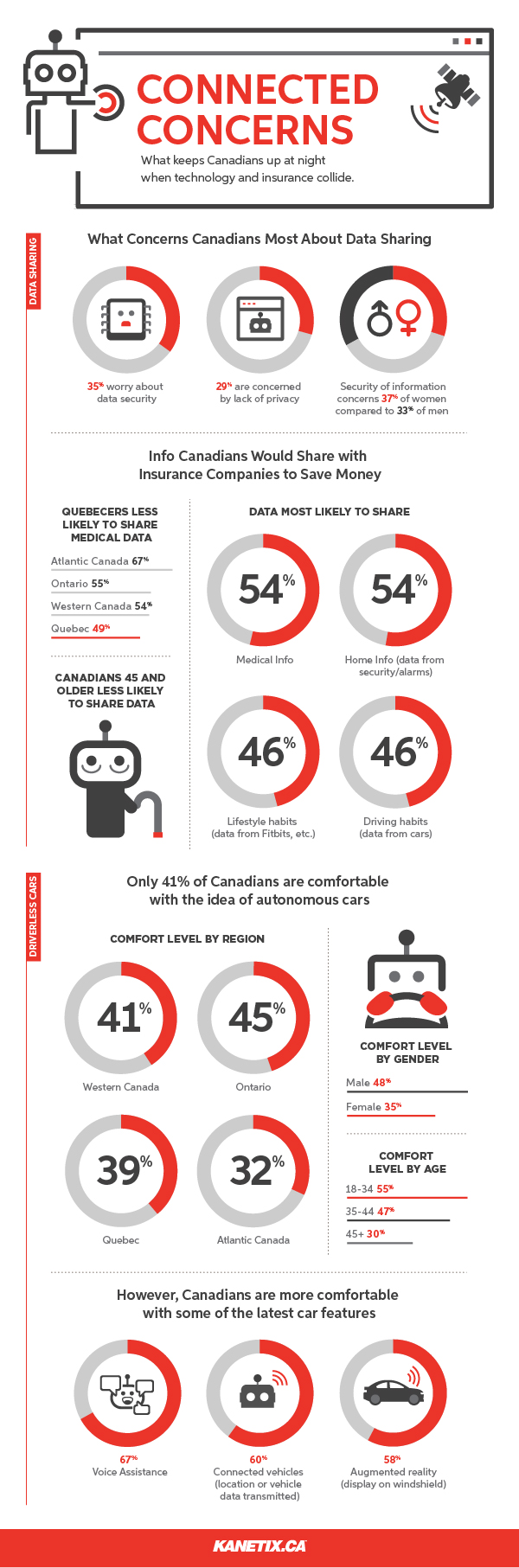

From auto insurance to life insurance and everything in between, would you be willing to share additional information with your insurance provider if it could help you lower your insurance premiums? The type of information, for example, that is gleaned from technology that you may already be using, like Fitbit, OnStar, Google Assistant, or Siri?

Turns out, about one-half of Canadians are open to the idea if it will help them save money, according to a recent Kanetix.ca survey on the topic of technology, insurance and data sharing. But that doesn't mean Canadians are carefree about the use of their personal information; in fact, 35 per cent worry about their information being hacked, while one in five fear the information could be used to increase their premiums.

Survey Highlights and Infographic

Around the home: If it helped lower home insurance premiums, 53.6 per cent of Canadians would be willing to share data with their insurance provider that's collected from their home's fire, flood, or burglar alarm and sensor systems.

In the car: While there are many automotive technologies that Canadians are ready to embrace, there's one that Canadians are keeping in neutral: autonomous vehicles. In this survey, 59 per cent said they were not comfortable with the idea of self-driving cars, while in a similar survey last year, 56 per cent said they were hesitant about the emerging technology.

Healthy living: Even though 53.8 per cent of Canadians are willing to share medical and health information (like heart rate and blood pressure) for lower premiums, they're less likely (46 per cent) to share lifestyle habits like how many calories they intake in a day, or how many steps they walked this week.